Title: Gap Up Fader with Secondary Bounce to Highs

Strategy: The general jist is that just after you think it has determined a trend for the day it has a pop up to the highs, probably makes new highs and looks strong enough that you don't wanna be short.

So in this case CNAT was on it's 3rd day up and had gapped up on news, and was fading hard premarket leading to the general bias tha tit would be an all day fader. After an initial move down it popped up and looked to be stuffing; that's the add point normally. At this point it's very important to stop out quickly on an up move in price. AND if you want to reverse it and get long it must be here, cannot chase new highs, must be selling into the new highs (even though it looks really strong at that point).

If the bias is strong enough on the short side, and this should only really occur when it has been weak premarket (and a bigger picture view) should be beginning short into the new highs and then adding on stuffs.

Friday, 25 September 2015

Trading Review: 09-24-2015

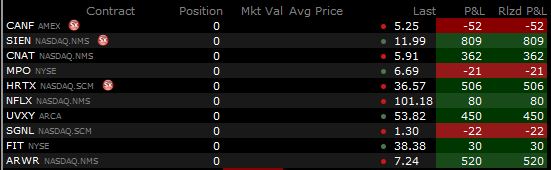

Main Account: +2662.

Really really solid day. Didn't make the same mistake as yesterday, although nearly did... Was up around $200 on CNAT and drew down to -200. The price action on it is some price action that I have struggled with so I will go through and work exactly where the executions should have been.

Did a really good job of locking some in and then building on the trades. Was never at risk of losing original $200 of risk... But clearly experienced a bit of a drawdown on CNAT.

Overall one fault was needed to do a better job of continuing to push it after having really solid morning read. For example: (1) UVXY expected once it broke uptrend it would come off pretty hard, could have captured this easily. (2) HRTX had a solid bounce when it finally bottomed as it was completely oversold (no need to force it, but should have been looking as it had the volatility). (3) CNAT/ARWR continued their selloff and could have pushed sized on appropriate setups late into the day.

Wednesday, 23 September 2015

Trading Review: 09-22-2015

Main Account: -$412.

Actually started off as quite a good day, locked in a little on WFT and UVXY. Happy with the UVXY trade. Ultimately was just trying to push it a little too much on WFT.

I made the observation premarket that it was a crowded short. A really good reminder that unless things are perfect I should be waiting for the prices I want to enter a trade, rather than trading the momentum. Especially on the larger stocks. Waiting for prices would have yielded some decent profit on this stock.

Tuesday, 22 September 2015

Trading Review: 09-21-2015

Main Account: +$622. Really solid day. This is basically exactly how I want to be trading, was never at risk of a single trade losing too much money, and I was adding on confirmation over time once some profit was locked in. One particular example was FIT where I shorted a little, covered, then added back a little more.

Arguably traded a bit too many stocks. Could have honed in and focused a little bit more.

Was a really good stock I could have traded max size on back account, so a bit of a shame not to have been able to take that. But happy to hone in with consistency for now.

Thursday, 17 September 2015

Trading Review: 09-16-2015

Update: Have been a bit lazy recently with reviews etc.

For the past 3 days am down $2674 on main account and up $1022 on back account. More interesting is that am down the past 4/4 days on main account, which is by no means a coincidence. There is definitely some correlation between the laziness in reviews and the poor results but have also been trying to go for home runs a little too much.

Posting this to acknowledge the need to go back to core profitability; that is, taking profits abnormally early and focusing on getting exceptional entry.

For the past 3 days am down $2674 on main account and up $1022 on back account. More interesting is that am down the past 4/4 days on main account, which is by no means a coincidence. There is definitely some correlation between the laziness in reviews and the poor results but have also been trying to go for home runs a little too much.

Posting this to acknowledge the need to go back to core profitability; that is, taking profits abnormally early and focusing on getting exceptional entry.

Friday, 11 September 2015

Trading Review: 09-10-2015

Main Account: +$214. Really really solid start to the day, was never really at risk of losing any more than $200-$400 on the open and was up about $1300 across NFLX, VTAE and LULU. Gave back a little bit via stops (which is okay) and then a bit more trying similar positions.

But the big one was MBLY. So I decided I would push the size on it because it was a premium setup that made a lot of sense... That's fine! Then after I had sized I added about another 4/5s of position which basically made to too big. I only lost about 20-30c on the position and that amounted to a little over $500 loss.

Later in the day was a really good opportunity on ZSPH. I was patient for prices I wanted and missed which is fine... But there was plenty of opportunity in ZSPH and could have easily revisited.

Then went a little on tilt and traded MBLY end of day on a good setup with too much size. Actually ended up making a little back but it was real silly stuff when I had already decided I was done for the day.

To sum up... I am crushing the open and giving quite a lot back midday. Sure sometimes I make some money midday but not really worth the effort unless a really good setup like ZSPH with plenty of potential volatility. The other comment is that things that have done exactly what expected on the open I probably should keep some on for them because likely to continue to have a good read. That and stocks with fresh news, and catalyst flow. Rather than say a nice stock to trade (like NFLX, GPRO) but with no fresh catalysts; these need to be mean reversion trades midday.

Back Account: +$1057. Traded VTAE pretty well on back account. Ended up getting stopped on a full position size and still made money, so pretty good!

Thursday, 10 September 2015

Trading Review: 09-09-2015

Main Account: -$1319.

Back Account: -$1229.

Ended up making the same mistake that I did yesterday. I guess I should be grateful for a little kick in the ass instead of a bigger one.

The basic mistake comes down to the fact that I was sizing in too early on the open. Yesterday I did it on two stocks, and today I did it on two stocks. What I have been doing is having a little position premarket, and then the moment it ticks in the direction I want it to on the open I have been sizing in. This is completely wrong! (Note that there is an exception if you a stop-loss above/below the opening print, but that's not wht I'm talking about here).

What I should be doing is:

(1) Pick prices that I want to get 1/4 or 1/2 at. These are the only prices I should be entering at prior to trend determination, which happens at the earliest around 9:45.

(2) Then only add once trend has been confirmed and risk defined. Ideally have also taken some profit on the 1/4 or 1/2 to lock in some cushion.

One good thing about today. I had patience on the VTAE short and didn't begin shorting it until it began changing direction.

On the negative side. The NFLX loss should have only been around 150-400ish, the AKBA gain should have been multiple 000s, and I had been planning to size in on main account as well, and the VTAE loss I should have had a hard stop-loss in and saved approximately $500.

Wednesday, 9 September 2015

Trading Review: 09-08-2015

Main Account: +$1144.

Back Account: +$460.

Am posting this review a day late... Got lazy... Funny thing is that I repeated the same mistakes (which maybe I would have learnt from had I done the review on time? Probably not though to be fair). So anyway it calls for a going through of methodology/what's going wrong just to stamp it in the butt.

Today was a really poor day overall. Should have made at least an extra $1000 but was bag-holding positions that I went full size in far too early. One of these was accidental (but I didn't correct it immediately) and the other was a lack of patience.

I think the first thing to realise is that my patience has got a lot better and the mistake partially arises from not cementing a proper plan/methodology in my head. This is why I want to go through and outline exactly how most of my plans on the open work (aka the ones recently that have given me trouble); and then I will print it and ensure it is in my head for the coming weeks.

The trading on the back account on NSPH was perfect. Especially considering the fact that it wasn't a perfect setup for me, but executed on it really well and added to a winner.

The trading on THRX was really bad. Arguably the second trade was okay (definitely a lot better). (1) Put size on all at once. (2) Didn't have the patience to wait for the price I wanted (which it actually went to and provided a nice initial entry!)

Tuesday, 8 September 2015

Weekly Review: 09-06-2015

Main Account for the week: +$11960.

Back account for the week: -$563.

Solid week overall, my biggest positive is that I am continuing to make conviction market plays (the oil one). This arises from the volatility which creates really solid opportunities... But it is a nice change to be able to make market conviction plays rather than micro-cap conviction plays. A really good development in my trading.

Biggest negative by far is the impulsive trading. By most part this applies to my trading through the execution of an idea. The biggest example from the week is the big negative day I had in back account, but there were also some examples in my main account like GBSN etc. Basically go too large immediately and don't micro manage the position to get to the size.

Clearly this still arises from when I went through my strength and weaknesses and this was my number 1 weakness!

Back account for the week: -$563.

Solid week overall, my biggest positive is that I am continuing to make conviction market plays (the oil one). This arises from the volatility which creates really solid opportunities... But it is a nice change to be able to make market conviction plays rather than micro-cap conviction plays. A really good development in my trading.

Biggest negative by far is the impulsive trading. By most part this applies to my trading through the execution of an idea. The biggest example from the week is the big negative day I had in back account, but there were also some examples in my main account like GBSN etc. Basically go too large immediately and don't micro manage the position to get to the size.

Clearly this still arises from when I went through my strength and weaknesses and this was my number 1 weakness!

Monday, 7 September 2015

Trading Review: 09-04-2015

Main Account: +$769.

Overall a pretty neutral day excluding AMBA. The thing I am really happy with AMBA on is that when it displayed relative strength to the market I added to position. A really solid trade, and caught most of the move.

VNCE and JOY actually provided opportunities again so I should have revisited and that would have easily made up for the losses experienced in those stocks. I was sized in on VNCE so that's a reasonable loss considering.

UVXY I made money shorting it, despite it going up all day - so that's really solid. I tried to reverse it and go long but was stopped out and missed a really really decent trend.

I think probably the key takeaway from today is two things:

(1) There's a difference between flexibility in bias and reversing position immediately. On UVXY when I reversed my bias it didn't mean that I needed to jump in straight away.

(2) Revisit ideas if the idea still makes sense. E.G. VNCE never breached it's high and started moving down. E.G. JOY did negate short bias by a BIG pop, but then it rolled over and provided a good short opportunity.

Friday, 4 September 2015

Trading Review: 09-03-2015

Main Account: -$214. For some reason this was a hard hit. Probably the hardest $200 I've ever lost. I think part of the reason is that I was trading really well, with really solid accuracy, then gave back quite a bit on UVXY (drew-down 500), LCI (300). Then made a couple of poor trades (KBIO, GBSN) to bring it to the total.

Overall am actually pretty happy with the day, when I reflect on it in hindsight, was more that at the time the hit was bad psychologically. Think I was just getting a bit fatigued.

Note that KBIO was the result of two trades, one that worked and one that didn't. Both similar trade sizes so you can se the risk-reward just wasn't good!

Probably the biggest factor for me to note here is that I have repeated drawn-down somewhat through the day so I need to limit the trades made after the open, and very reluctantly change biases. Look for support/resistance plays off levels (but not breaks of the levels), rather than momentum plays (unless there's some para etc).

Thursday, 3 September 2015

Trading Review: 09-02-2015

Main Account: +$1538. Had some really solid ideas premarket but unfortunately I didn't get the prices I wanted and then I watched them all work out!! So that was kind of annoying, they were big moves as well! But overall pretty happy with execution etc, was patient and didn't feel the need to chase or anything.

In hindsight AMBA was a marginal trade, but kept it small so happy.

The oil trade was a horrible trade and an example of one that should have been executed via the ETFs because it wasn't high conviction, like yesterday.

Back Account: +$1991. BVXV was a virtually identical setup to all those other fade the low float massive gap. Given my smaller size I decided to try and trade it a bit more actively than I usually would. Usually I would get short, cover some and hold 1/3 until the end of the day.

Trading it actively had a couple of benefits, and some negatives. Overall, I feel like the positives far outweighed the negatives; but I think it is a case by case basis.

The positives were: (1) I was able to hold more size for more of the move, because the stop-loss was trailed more aggressively and very clear where my bias was changed. I feel like this was a big advantage when it reached the point where you "knew" it was closing near the lows because at that point you could keep the size on. (2) On net more profitable and opportunity maximised.

The negatives are: (1) Forced it a little too much instead of waiting to add back after the half cover (this is more of methodology point of view though and easily improved), (2) Most of these setups do have some wee afternoon bounce, even after you "know" they're absolutely crushed, so you don't wanna be in full position size when that happens.

And just a general comment is that it becomes more important to provide liquidity because of the increased trading activity.

Tuesday, 1 September 2015

Trading Review: 09-01-2015

Main Account: +$9777. Really interesting day. I was looking at the stocks available to trade, nothing really stood out, then I went through the oil setup (which could have been executed via oil etfs) but I decided that my time would be best spent trading futures instead of stocks given the size of oil edge I had. Obviously proved to be a good decision!

Really happy with execution overall, but it was another one of those days where my idea didn't work straight away and by chasing I ended up with poor prices. One of those tough judgement calls to make.

Another comment about UVXY is that the moment I tried to go full size and get risk tight I got stopped out, yet the idea still worked out. Was long around $81 and targeting $90, which worked, and there was a tight trendline that it had respected all day. Finally before it took off it made a lower low (but not lower high obviously). I would have been better off not trying to get size and trading around position, selling pops buying dips. Tough one!

Back Account: -$97. Was one of those days where my ideas didn't work in the bigger scheme of things, but managed to make money on an idea so pretty happy with execution.

Trading Review: 08-31-2015

Main Account: +$90.

Back Account: -$2547.

Bit of a disappointing day overall. Started off really well nailing MDCO for decent profit and then narrowly missing shorting VTL with size, then turned into a day of forcing it which resulted in some trades that should have been starters etc. Overall gave back too much, trades weren't overly bad or anything though, just could have been executed better with smaller size, and not chasing.

Was a very disappointing day on back account. Very reminiscent of the day when I went too big. AXPW was a bad trade in the first place, but it was with way too much size and the size was put on all at once. Lucky the back account is so tiny I guess because I need to correct the behaviour!

Subscribe to:

Comments (Atom)