Thursday, 24 August 2017

Trading Review: 08-23-2017

Gross PnL: -$462.

Net PnL: -~$570. $84 in borrows for 3 days.

Really really off my game... Not really much else to say.

Anyway took RTNB for a swing, and will take rest of the week off.

Happy with AM trades, except stop was a bit late.

To sum up, having a couple of losing days finally cracked me and appear to be trading with the "crowd". Need to mentally reset and get back into the grove. Come Monday it will be very important to nail a couple of quick $50-$150 trades and not try and hit the big trade.

Wednesday, 23 August 2017

Trading Review: 08-22-2017

Gross PnL: -$626.

Net PnL: -$724.

Kinda weird day because I don't think I traded too bad, but the size of this loss is unacceptable. Took my stops as they were planned but didn't quite expect it to be this bad.

Additionally this is the third losing day in a row. Last 12 days prior were 9/12 profitable, so an obvious change in character of my trading. Anyway going to pull back size briefly, just for a couple of days.

So the root cause of this slight change is just trying too hard to capture moves, and not sticking to methodology. That is to say, when something is above vwap I should be shorting against the high, and covering into vwap. I have been holding for the downtrend too much! Just a slight change, but making a big difference.

Tuesday, 22 August 2017

Trading Review: 08-21-2017

Gross PnL: -$261.

Net PnL: -$328. $33 in borrows.

So today is kinda how last Friday should have gone. Yes poorly executed, and pretty decent sized loss, but took stops and ended day roughly around max drawdown.

Execution mistakes today were:

(1) Entering full size straight away ARCI.

(2) Not being more aggressive to take profits, and therefore recycle. The risk-reward on the trades I made was only acceptable with some recycles.

JMEI - Good grinder trade, didn't have a super strong bias so not reason to push it; and never got filled with too much size.

RTNB - Well executed, only slight mistake was not being a little less greedy with cover; and then putting it back on.

ARCI - Good stop in the end. However shouldn't have been stopped on the first trade. I had a strong bias (which I stand by); and definitely should have been ensuring I was in the position to recycle.

Monday, 21 August 2017

Trading Review: 08-18-2017

Gross PnL: -$657.

Net PnL: -$710.

Pretty pissed off about today! So put simply I didn't take a stop where I needed to.

But, the cause was that I entered where I thought there was a held offer, then struggled to stop when it got through there; because I had originally planned to scale higher. Also re-entering after getting stopped too soon.

I would have actually done alright out of this stock based on the size of the pullback it had if I was disciplined.

Side note: The SVXY trade not working is why I need to wait before trading the higher ranged stuff, could have easily scaled into that trade and it would have been a winner.

Thursday, 17 August 2017

Trading Review: 08-17-2017

Gross PnL: +$247.

Net PnL: +$125. $34 in borrows.

Incredibly unlucky with fills today, absolutely crazy how many times I was bidding at the low of the day, and it traded there (sometimes even big volume) and then I didn't get a fill. And I'm not talking about BITCF either...

Big thing today, was that I was up around $350ish - and I was actually on the cover side of things trying to reduce positions (eg see IDXG), and as mentioned getting very unlucky with fills, and ended up around +$50 - +$100, then exited at favourable places for my net result.

BITCF - Didn't have a super strong bias on this today, but added as it confirmed idea and clean stop-out area. Covered too early, but that's fine as I didn't expect too much.

IDXG - Happy with entries and idea (just the gap down and crap-out type setup). Realised quite early that there wasn't going to be a huge move, so set what I thought was an easily achievable bid for half (1.21) which turned out to be the low of day and no fills for me.

SDLP - Was extremely biased on this stock today, thought it had a decent chance of filling the gap. A great cover that I took near the lows, that I am super happy with. I locked in $92 on this at the low, this was my best move of the day - locking in despite strong bias.

Then I added back into vwap, which was my biggest mistake of the day (don't use vwap before 10am at least); and ended up covering the rest around even.

If I hadn't locked in I wouldn't have made money on this ticker; and if I had added near the high of day (instead of vwap), it would have been a nice winner despite idea not really working.

Also worth mentioning I was slightly unlucky on fills on this ticker as well.

Wednesday, 16 August 2017

Trading Review: 08-16-2017

Gross PnL: +$280.

Net PnL: +$156. $49 in borrows.

Kind of a weird day, no A+ setups but I wouldn't say that I was forcing trades on these either - yet still ended up trading 3 tickers.

BITCF - Had weird issues getting fills, INCLUDING when it was moving in my favour. The fill I got near the bottom was a limit order that had been sitting in there since $1.70. So I literally don't understand that in the slightest.

Kinda got lucky on BITCF, good job scaling in cautiously, but it really tested me and put me to the uncomfortable level. Am quite happy with how I traded it though, scaled in slowly, covered down risk - then added back.

Definitely clean reminder of how cautious you have to be on OTCs.

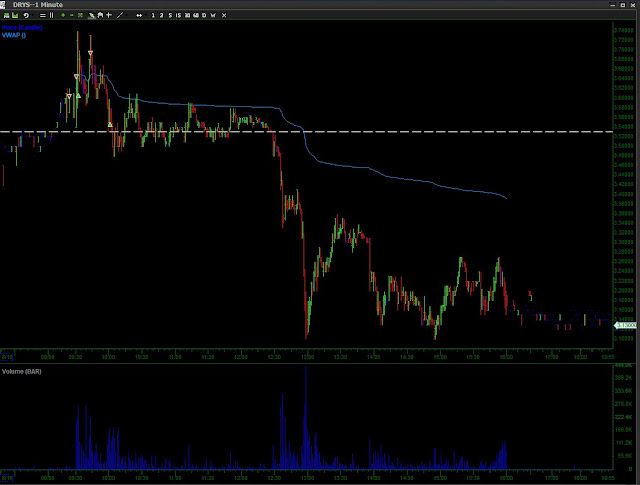

DRYS - Got the failure I had expected, but wasn't biased enough to actually push my luck, so am okay with the trade.

RADA - I should have been more aggressive on this. Got the high probability fade-off I expected and only filled 200 of the 1200 shares I should have.

Trading Review: 08-15-2017

Gross PnL: +$235.

Net PnL: +$122. $44 in borrows.

Bit of an annoying day. Had the BITCF trade all setup and then it got the crossbones premarket. Chased the gap down as it was confirmed, and actually quite happy with how I got some premarket then added.

Execution was EXTREMELY hard, and so HMNY pretty much got ignored which was a big mistake as it was a gimme, had plenty of volume and a reasonable move.

Other thing is that I was up roughly $600-$700 at the peak, so was obviously a mistake not to cover any. Aside from that it was quite a difficult trade as it made new lows then rallied back. I literally went to stop myself out and it rallied.

Tuesday, 15 August 2017

Trading Review: 08-14-2017

Gross PnL: -$85.

Net PnL: -$155. $24 in borrows. This doesn't seem quite right, but w/e.

Quiet day with no much on. Am really really happy with my stop-out on the second DRYS trade. A great read (wick below vwap that held), but also great discipline and flexibility (in the face of adversity).

Probably wasn't quite 100% prepared for the high of day push (as my methodology suggests I should be) on the morning trade.

Sunday, 13 August 2017

Where I'm At Currently

Have been doing some really solid grinding lately, and am really happy with myself.

However, upon reviewing all the pnl's and trading, despite massive improvement, I'm still not quite happy with where I'm at.

Before going through all the reviews, I had intended to increase my size. This certainly makes me less confident.

However, I think it needs to be done. I have been extremely consistent; and it's very important to increase size incrementally rather than all at once.

So currently:

- Sub $3 (somewhat range dependant) is a max of 800 shares, scaled in as 200, 200, 400.

- $3-$10 is a max of 400 shares. Scaled in at 100, 100, 200.

Will change this to:

- Sub $3 a max of 1200 shares, scaled in as 200, 400, 600.

- $3-$10 a max of 600 shares. Scaled in as 100, 200, 300.

It's not ideal as it's a slight change in methodology. But I'm not quite willing to double my size to keep the scaling in the same. Who knows, maybe I will like it.

However, upon reviewing all the pnl's and trading, despite massive improvement, I'm still not quite happy with where I'm at.

Before going through all the reviews, I had intended to increase my size. This certainly makes me less confident.

However, I think it needs to be done. I have been extremely consistent; and it's very important to increase size incrementally rather than all at once.

So currently:

- Sub $3 (somewhat range dependant) is a max of 800 shares, scaled in as 200, 200, 400.

- $3-$10 is a max of 400 shares. Scaled in at 100, 100, 200.

Will change this to:

- Sub $3 a max of 1200 shares, scaled in as 200, 400, 600.

- $3-$10 a max of 600 shares. Scaled in as 100, 200, 300.

It's not ideal as it's a slight change in methodology. But I'm not quite willing to double my size to keep the scaling in the same. Who knows, maybe I will like it.

Trading Review: 08-11-2017

Gross PnL: +$1188.

Net PnL: +$1101. $50 in borrows.

Probably the worst day trading in a long time.

Notes for the trading day say: "Be very careful, can always add to a winner when the time comes. Want the high probability trade.

Plenty of meat so no need to be early.

Also be prepared for fakeouts."

I did all this on TOPS and AEZS. Unfortunately didn't do it on DRYS. Really frustrating because it's the first real opportunity have had in a long time, so not happy to completely mess it up.

But at least I made money I guess. Definitely clear that I struggle a lot more when I can see the big opportunity, and struggle with the fomo etc.

One other comment is that I could have recycled DRYS a lot more than I did - especially because I mucked up the other part of the execution.

Friday, 11 August 2017

Trading Review: 08-10-2017

Gross PnL: -$319.

Net PnL: -$367. $22 in borrows.

Forgot to do review because of the DRYS gap-up that distracted me. Which kinda makes this review a little funny.

I was extremely pissed about getting stopped on my swing DRYS short, and with the gap up am really glad that I did.

However, the big mistake was not covering any into the lows, for a rinse and repeat which would give me a bit more flexibility.

Took a UVXY trade today that I am very happy with despite it being a loss. Was very disciplined in the execution, so am happy. My read on the bigger picture was accurate as well as it hit $44 after-hours, and the setup aligned - just simply didn't work, which is all good.

Worst trade of the day was RADA. It cracked like 20c as I was entering my order, so I chased it down with partial, and then scaled in as I should have. Would have been a nice trade if executed correctly.

ACHN - really happy with this. Was a grinder that I kept on my radar for a day 2 play. Got a little bit greedy, but just happy I kept it on radar. A nice setup overall.

Thursday, 10 August 2017

Trading Review: 08-09-2017

Gross PnL: +$114.

Net PnL: ~+$90. No borrows today which is nice. Fee in account so not sure on exact.

Kinda nice not to have to pay borrow fees for a day. Flipside of that is that they are "real" companies so not quite as clean.

ACHN was a pretty big opportunity today, plenty of meat on that move from the high. A few minor mistakes on ACHN, not too worried but definitely worth noting:

(1) Loss on first trade was $140, which is too big. Took the stop as planned, so just a bit annoyed about magnitude of it. The other reason I'm not too annoyed about it is that I made more money on the eventual downside, so risk-reward was sound enough.

(2) Not covering any into the first vwap test. This is especially important because it tested me. Missed an easy recycle, only $20 in the recycle - so it's more about the risk covering.

CEMP a really clean trade, if it wasn't for the fact that it was a 5c tick pilot.. So that's fucking annoying. Definitely not maxmised - but am okay with that.

One thing really happy with on CEMP is how I scaled into the position. Was slowly as it confirmed.

Wednesday, 9 August 2017

Trading Review: 08-08-2017

Gross PnL: +$146.

Net PnL: +$84. $11 in borrows.

Really good trading on CLRB, and really happy overall.

PACB a bit unfortunate. Keep getting wicked out on these real companies - ended up closing at $4.15, so a massive move. Literally stopped at the top.

But where should my stop have been? Cause it had broken the high and by a reasonable amount, that you wouldn't consider it a fakeout. Definitely looked overextended where I stopped though.

Probably the mistake was reshorting what I covered into the wash too early?

Tuesday, 8 August 2017

Trading Review: 08-07-2017

Gross PnL: +$112.

Net PnL: +$40ish. $28 in borrows.

Grinder style short on CLNT - which I narrowly missed a lot better entry on. Was very happy with my patience on this though. With the super low float being cautious was definitely the right idea.

XXII. I can't make up my mind on this. Had two trades, one winner, one loser. Overall the idea "worked" and if it weren't for my tape read entry on first trade I would have only had one winning trade on it.

So there was a 200k bidder on it on the open. Printed a few, had a decent bounce, printed some more, smaller bounce, then started getting taken for them all. That's when I entered, stop at high. I definitely stand by my read; question is should I have stopped when it got back over (didn't immediately melt down); or should I have stuck with original plan and ignored the clean tape read.

Am not sure, and to be honest no idea what the right answer is, but worth pondering about.

Sunday, 6 August 2017

Trading Review: 08-04-2017

Gross PnL: +$72.

Net PnL: ~+$30. $32 in borrows.

Literally no setups for me today, so am very happy that I didn't participate. To be completely honest DRYS probably wasn't even something I should have been in either.

That being said, some great entries; and if I had the cover on the first short, which was narrowly missed it probably would have been a reasonable day.

Friday, 4 August 2017

Trading Review: 08-03-2017

Gross PnL: +$188.

Net PnL: +$120. Bit hard to work out because there is a fee in there. $40 in borrows.

Again, good trading around the DRYS swing position; unfortunately it sort of proved that the swing wasn't worth it again today.

Was looking for low $1s on the covers (on the swing), and narrowly missed my first bid. At this price the swing would have been well worth it.

Ended up covering at a somewhat unfavourable price. Think this was a little impatience, not waiting for the end of the day - bit of a gimme that it would close at the low. But even so, just never caught a huge move on the swing.

RDFN - A perfect setup, but not on my niche type stock. It is a hyped a ipo, so the behaviour is close; but the price isn't. Only took it for 100 shares; and was very cautious with where I wanted to add. Obviously completely minimised, but I am actually really happy with my caution when I expanded my horizons. Taking profit early is a form of risk management.

Am also quite happy that the setup played out as expected, and thus it was worth me venturing outside of niche to trade this one.

Wednesday, 2 August 2017

Trading Review: 08-02-2017

Gross PnL: +$1302.

Net PnL: +$1279. $40 in borrows for some additional DRYS.

Side note: Want to clarify that today was different to when I swung a bit more size (stubbornly) than I should have on DRYS a few weeks ago. Executed today with solid plan and risk in mind. Intraday was never down more than $300.

Today pretty much answered my question on whether I should have swung DRYS. If you look at pnl it suggests I should have; but I view this slightly differently.

The closing price of DRYS today was mid $1.30s. To me this suggests that there wasn't enough meat of move to justify taking the DRYS short prior to this morning.

Yes, the rally yesterday to $1.50+ (where I decided to take the swing short) was indicative that a good entry was approaching; that could be held for multiple days. But ultimately it comes down to front side of move, vs back side. There was plenty of time to establish a position in this pricing zone. Anyway takeaway is that it makes sense to swing 800 shares at the price I did; not 1600.

I was prepared for a gap up and slight rally - but I wouldn't have liked it. At 800 shares I would have wanted it; yet still would have had time to establish a swing short at $1.50+ if it didn't make another high.

Really happy with my trading around DRYS today. Wasn't scared to short strength with a stop, and managed to recycle some, then use profits to get into a position where I could hold full size for most of day.

A slight mistake on entry of the second short, perhaps half should have been there; and another half into the high. But given I had already locked some in, wasn't a big deal.

Note: Re-entry was offered on the vwap pop. And I had originally planned to get back in aggressively around that price zone (actually had orders already in while I was still up), but I went to bed; and am comfortable that I didn't.

Subscribe to:

Comments (Atom)