Wednesday, 28 February 2018

Trading Review: 02-27-2018

Gross PnL: +$1040.

Net PnL: +$885. $63 in borrows.

Churned through the tickets today, in a well executed trading day - where no idea worked completely cleanly, but I traded around positions to create profitable trades. AKRX did work, but I thought it was crowded so covered down. A shame, but happy to lock in a good day.

MDXG - had a hint of a revenge trade on it, particularly with the size (although I was up reasonably on the day at this point so had a bit of room for risk). There was a stop that I should have taken on it, but didn't (not paying enough attention). A good cover eventually though (which took a bit of telling myself it was the right thing to do), and then a good re-establish of position - before the eventual realisation that there wasn't enough meat in the move.

Tuesday, 27 February 2018

Trading Review: 02-26-2018

Gross PnL: -$1589.

Net PnL: -$1721. $72 in borrows.

Couldn't get borrows for the easy play today - real pain.

First bad day in a while - although I stopped at the high (and had anticipated it as being the high) it was still the correct thing to do to protect myself.

My mistake was not stopping on the first MDXG short as it got over vwap. Then as it turned into a fade play I was already in from too low to correctly trade the levels I wanted to.

So despite everything - that is, giving back more than what I earned last week. I am still pretty happy. Had the right mentality to eventually stop out and not turn it into a rougher moment. Now if I could step it up to the next level and take the stop when I should have, would be at the next level.

Sunday, 25 February 2018

Trading Review: 02-23-2018

Gross PnL: +$604.

Net PnL: +$591.

Was somewhat lacking the energy and motivation, even contemplated taking the entire day off when I was staring at my possible setups around 9am.

Given lack of energy I did take off once I had locked trades in, even closed them early. Ironic thing is that I got lucky because this meant I nailed the sell on CBIO.

W did continue going lower, BUT it eventually turned so I probably would have given back a bit.

Good end to the week, given a few mistakes this week and can close out nicely profitable.

Friday, 23 February 2018

Trading Review: 02-22-2018

Gross PnL: +$1358.

Net PnL: +$1336.

Really nice day, wouldn't say I had the best ideas, nor the conviction on them; so gifted with a 100% strike rate. Have been struggling the past few days, and nice to see a day surpass the last few days neutrality. Getting paid for keeping those losing days small, even though I could have done a better job of it by far.

Management wasn't the greatest, got lucky on some spots; and a terrible initial entry on W. But with some good fills, and little bit of willingness to fight it (OSTK and W have never been the cleanness, not to mention the spread requiring getting liquidity providing entries) ended up getting some good entries and covers.

Thursday, 22 February 2018

Trading Review: 02-21-2018

Gross PnL: -$496.

Net PnL: -$585.

Pretty annoyed with the day, same mistake as previous day. Had plenty of opportunity to call it early as well. Further more, my first trade on SLCA was a sick trade; then I gave it back by being a tad aggressive - getting in too early, with tad too much size leading to incorrect stop.

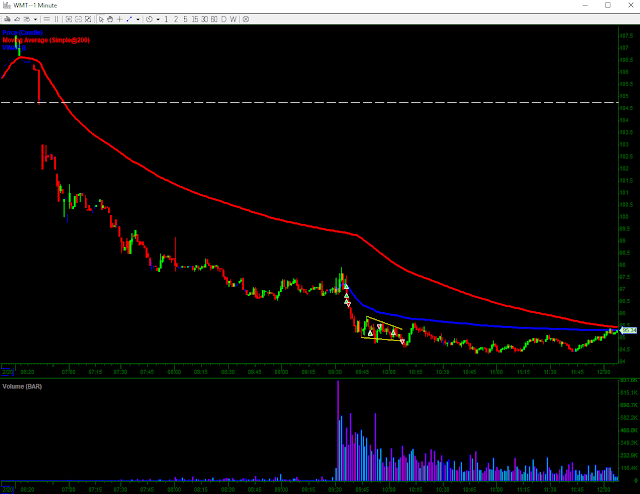

Thing is, I knew WMT had room to $90 for gap fill, so what was I doing? The other thing is that each of my individual entries gave a wee pop (at least initially before a fraction of tilt set in), so I was reading the tape good.

Main thing is, took stop after stop after stop. So drawdown, and potential drawdown limited.

Wednesday, 21 February 2018

Trading Review: 02-20-2018

Gross PnL: +$850.

Net PnL: +$780. $60 in borrows.

Odd day. 1/5 from 5 success rate, and I feel like my trades (except for DCAR explained below) were all reasonable.

Was kind of one of those days where the trades I took didn't work and the ones I didn't take did work.

Ran into a problem with DCAR, it was setting up for a nice scalp; but I had a few positions on and ran out of buying power (ACHV short tying up a lot - no margin on it). I also couldn't give it the attention it deserved. The distribution was obvious, but just not enough focus.

Good stops all day round today though. Thought about changing bias on WMT, which would have worked; but on a shit day decided to lock in the profitable day.

Risk-rewards all solid today; losses could have been slightly smaller, but more or less on point.

Finally, today was probably the first time in a long time I've got my sizing right on one of these microcaps. Usually I go a little too small, and then on the really good ones I go a little too big. Once everything was lining up on ACHV for an all-day fader I was conservative with my bids to cover, and they kept getting narrowly missed. Would have been a simple recycle of position. Probably a little lucky in a way that it actually did fade, but am happy that I kept to plan.

Tuesday, 20 February 2018

Trading Review: 02-16-2018

Gross PnL: -$613.

Net PnL: -$652. $12 in borrows.

Was light on ideas for the day and then one of them played out premarket.

Annoyed about today overall. I was soo happy with myself when I hadn't taken a trade before 9:45, then when I acknowledged that I was doing well I let slip and took a few substandard setups.

Losses relatively contained I guess, so probably can't complain too much, but certainly not ideal trading and a mistake I will need to fix at some point.

Friday, 16 February 2018

Trading Review: 02-15-2018

Gross PnL: +$410.

Net PnL: +$382. $19 in borrows.

Solid day, simply got done what I needed to get done.

Only solid idea for the day was to short ZN, but it had been choppy the prior two days so wanted to make sure I was trading around position.

SHOP was a secondary idea that the price action made it an A+ setup, was a little bit scary though given wide spread. Obviously worked to perfection. If I had been trying to push the day I would have got long at $130 for a ride back to at least $133 after covering my short as well. But all good.

Again, same for tomorrow. A couple of hundred dollars and done for day. Trade around positions, don't be greedy, small size, be willing to miss a trade.

Thursday, 15 February 2018

Trading Review: 02-14-2018

Gross PnL: +$8906.

Net PnL: +$8746. $66 in borrows.

Had conviction on FOSL and held most of position for most of move. Am very impressed with my flexibility of thought - I nailed the trailing stop on it (didn't quite get as low as I wanted); and I was looking long.

Unfortunately I exhausted myself on the long prior to the clean break, thus sold into the spot where I should have been adding.

Caught myself "trading with a target" as I wanted to withdraw NZ$10,000. Annoyed about this as it led to sloppy trades; in particular SHOP but also to some extent the FOSL long (early). But I realised it early and cut it off.

Big problem with today, and I am very FUCKED off about it. Will copy what I said on chat about 30 minutes after entry as it nails my poor mindset. "sometimes my conviction of an idea ruins my execution - a normal stock i would have crushed this price action". Next time I have a conviction play I need to bear this in mind.

For tomorrow, and probably the coming days. Need to focus on resetting mindset. Don't want to find another conviction play, and another, which will lead to a completely destablised mentality. Back to the grind. The big winners will come.

Wednesday, 14 February 2018

Trading Review: 02-13-2018

Gross PnL: +$657.

Net PnL: +$536. $91 in borrows.

First day in a long time I have put on too much size. Thankfully it was a situation where I could put on "some" size safely (thick float) so didn't get punished too bad.

But well out of order, and am annoyed with myself. Was too big on CBIO as well, although that wasn't end of world too big, just a bit too big.

It is tough to set goals for tomorrow because there is a setup that I would like to go completely balls deep on, but definitely absolutely need to be disciplined and follow my plan.

Tuesday, 13 February 2018

Trading Review: 02-12-2018

Gross PnL: +$307.

Net PnL: +$244. $47 in borrows.

Good day and got done what I wanted to get done - took it slow and din't force secondary setups. It's for this reason that I actually made money.

COLL and UVXY for secondary setups, which I lost too much money on. But if I had forced them it would have been a fair bit worse.

UVXY was only starter size (which was somewhat a stupid place to enter).

COLL was a reasonable setup, but narrowly missed a cover at morning swing low; and that kinda messed me up on it going forward. Ideally I would have been adding where I stopped (hindsight).

One thing I am very happy with is ICON. I missed the short, BUT that style of long trade - it was so heavy that usually I probably would have lost money on it, but had a great tape read and ditched it.

Monday, 12 February 2018

Trading Review: 02-09-2018

Gross PnL: -$1009.

Net PnL: -$1020.

Just real frustrating piece of dog-shit day. More of the same as recently.

Little bit too much aggression, little bit too much "looseness". The action price action played out as you somewhat expected, which is what makes this so frustrating.

Basically just needed a better plan to keep to.

Goal for Monday is to keep losses tiny, and work back a little bit of clean trading/routine. So small size, and stick to the better ideas.

Subscribe to:

Comments (Atom)