Thursday, 30 April 2015

Trading Review: 04-29-2015

Intraday Trading: +$3875.Finally the range broke on oil and managed to capture the entire move with size responsibly (trading in and out accordingly). Really happy with this... The other thing I'm really happy with is that I had anticipated it to break the range to the bottom, and while my bias was wrong I still managed to trade it perfectly! Great stuff!

One mistake was that I wanted to be out of the position by the fed speaking at 2pm, so I should have started offering out a little more aggressively prior to the meeting (in the last hour).

Swing Trades: -$262. Finally closed this position, wasn't an amazing trade, and with oil making a move could run again.

Back Account: -$3152. Was plenty of opportunity, when I look at my sheet there were a bunch of trades that worked out but missed the setup. Part of the reason for this is being in VALE around the open (which is fine), and the other reason is because the internet dropped out about 9:45 and had issues re-establishing which was frustrating (had mobile phone data on, but it wasn't quite that simple). This got me on edge a little bit, so the loss of LL should have been less (maybe even profit as met first target) but was a chase... And VLTC simply wasn't a trade.

It is interesting to look at the statement like this because I wasn't aware that VLTC made up such a large portion of the losses for today.

Goals for tomorrow: No impulsive trades, let the entry come to me... Don't want to get back into bad habits. Also need to focus on sizing in a bit better.

No charts for today - running a little late.

Wednesday, 29 April 2015

Trading Review: 04-28-2015

Intraday Trading: -$793. Another good job of controlling risk. Frustrating day narrowly missed offer at the peak on oil which would have made all this back, and then some. Volatility slowly seeping out of oil, suggesting my edge is diminishing as well.

Swing Trades: -$195. Still just holding, probably cover soon, no need to hold forever lol...

Back Account: +$1203. Cannot believe what a day it was. I traded almost flawlessly, but was caught in the TWTR earnings gap to the downside and crushed. Am extremely lucky that I was up big prior to getting crushed by the gap because a loss that size would have been devastating in isolation. So really happy to end the day on a profit - it's a step forward, and allows me to move on from a big hit without too much worry.

Lessons from today:

(1) Entering a limit order above the opening price WILL NOT fill you at the first traded price (TWTR).

(2) When feel yourself about to make an emotional trade remember that the opposite likely happens (in particular ADXS, but also somewhat CALM).

Thing done well today:

(1) Not only cut losses quickly, but also removed stubbornness from trades (EIGI and CALM).

(2) Good job of focusing on individual plays, and not getting fomo. Was a bunch of plays I had planned out which worked, but I missed because I was focusing on AGEN (on open) and late day plays that worked to plan but also missed. Didn't let this affect me (for the most part).

ADXS: Big lapse of discipline on this. The idea was that it was holding near lows, while IBB had bounced to a level where it could easily be considered bounce over... But of course it was a chase and not a good trade. Stopped self in good fashion, and ended up doing a nice midday fadeoff, effectively the play I was looking for but chased.

AGEN: Was a rehashed PR, 3rd day up, so a clear gap fade. Nailed covers on the way down, and began to anticipate closing at the lows. Naturally it did, but didn't revisit the trade after the morning short.

CALM: One of the tougher parabolics to short that have been in a while. The spread didn't make it any easier. Could have very easily got run over on this but controlled risk well and then nailed the real one with better size. There was one lapse of discipline where I chased instead of offering up, and that punished me to the tune of about 30-40c on 1000 shares (so I didn't control my risk very well with this).

I got one cover perfectly (taking off 3/5s of position, and reducing size part) but messed up the cover on the remaining 2/5s where I decided half way through the trade that it was going to be a scalp trade rather than a reversal trade (scalp target is vwap, reversal is hold to close). Either way is fine to play it... The problem was that I changed my idea halfway through and so didn't cover at appropriate place.

EIGI: This had a fraud research report come out on it, so was looking for the bounce after it settled down. I initially was at full size around $17, but did a great job of cutting losses around $16.80 when I recognised that it wasn't bouncing, then revisited at full size at $16 (longer term support), where it provided a great bounce. I managed to hold 2/5s until about $18ish (had been aiming for end of day, but it hit trailing stop. Would have been super impressive if I had been able to hold that long!!! Great trade!

While the volatility was great, the trade certainly wasn't an easy layup, but managed to nail it anyway :)

MSFT: Was a scalp against the $49 level on first test. Covered risk, and actually ended up closing the other half for profit to focus on something else (which was pure luck of course).

TWTR: The devil of the day... I got long into the $48.60 level, and it was halted and opened at $40. Earnings were leaked early, which were a miss, which was the reason for the move down, and the halt (investigating source of leak). So obviously I need to be more aware of halt risk... However, to a certain extent it was beyond my control.

So I kept my cool really well and didn't panic when it started indicating low 40s. Based on what others that I respect were saying about the numbers it seemed overdone in the low 40s, and was good for a bit of a bounce... So that's exactly what happened. I placed a limit order to buy the opening print (which apparently doesn't buy the opening print), and I got filled at $44. Had I been filled at $40 it was a perfect trade, so my strategy concept was fine... Just poor understanding of market micro structure. Had I been filled at $40 I actually wouldn't have lost much money on the TWTR gap funnily enough... But so be it. Key is to note that I actually had room to add to position (it wasn't like going mental and buying like a madman).

Cut losses when the bounce failed around $42.50ish.

So good lessons for the future.

Monday, 27 April 2015

Trading Review: 04-27-2015

Intraday Trading: -$215. Possibly a little over trading, but in general range bound action, and thus no big moves to capture. Really good controlling of risk today, so pretty happy. Below $56 triggers a short bias for trend, so there should be some good short trades if that occurs.

Swing Trades: +$375. Still just slowly working. Have bids for covers.

Back Account: -$2755. Not enough conviction in trades today. Was good opportunity, but the only two real conviction trades were SHAK and CLDX. Although there were other setups that I really liked but didn't take.

Three lessons from today (already knew 1 and 2, but good reinforcement, and 3 a new thing):

(1) Conviction trading requires attention to price action (along with everything else on checklist). However, there is a balance between paying attention to price action, and to taking it into account. This is demonstrated on SHAK.

(2) Don't hold a big trade for the entire day. You shouldn't ever be in the position where one single trade can determine your day.

(3) Paralysis by wanting high conviction. With SHAK today I wanted the high conviction setup, but by the time I was confident it was going up it had already completed a nice weak open r/g setup, and moved nearly its ATR.

BLUE: This was the most random trade of all - very bad trade, but got out immediately when I realised. There were two really good trades available on this. First, the weak open r/g (similar company had bad news), then the failed r/g move and short. I did neither of those, and they would both be high conviction, but that's okay!

I tried to join the trend late day. Silly trade overall.

CLDN: Massive gap down. Was looking for bounce. Didn't quite setup and stopped out. Can't see it on freestockcharts because my charts aren't working (but this was premarket). Should have been a starter position, and if it worked added to winner.

CLDX: $25 major level, so as big volume started coming in got long $25.40 and was stopped. Should have waited for $25 or nothing (low was $25.07 and had a nice 40c bounce off there). The reason for waiting for the $25 level is because when you go through the checklist required to make this kind of contrarian trade the time of day is wrong, and it is a biotech, so you need something else favourable to make the trade.

SHAK: Really really nice weak open r/g (support from yesterday) setup but as mentioned I got paralysis by wanting conviction. Would have been an amazing winner if I had traded it that way. Instead got long around 70, stop 69, and narrowly missed sales into pops.

You can see the stuff midday, and then the change of momentum midday (that was the price action not to get too caught up in cause it's midday) but then as it makes the lower highs - that was the price action to pay attention to.

Also stuff up execution of the stop and was out in the low 68s. Stop should have been 70.

WUBA: Wasn't a high conviction setup, kinda realised this halfway through and took profits quickly. As it turns about in the end it ended up going up quite a bit - but that's ok!

Turned into a really nice short on pops after two stuff and a clear change of momentum after a move above the ATR. Should have had the short - but had SHAK to focus on.

Trading Review: 04-24-2015

Intraday Trading: -$45. Just an oil trade that had the PnL reset for some reason - was stopped at approximately breakeven on it.

Swing Trades: +$75.

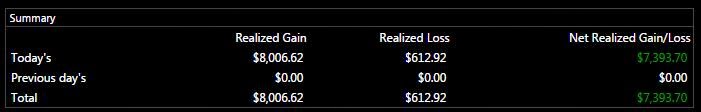

Back Account: +$7393. Continued today with the theme of high conviction trades in back account. Had a great deal of thinking about how to take the high conviction trades, and had a friend sitting with me to help ensure that I was only taking the really high conviction trades. The lessons learned from this week of trading in the back account are really really helpful and will aim to continue it this week.

There was plenty of solid trades today, but for the future will only be looking to take 1-2 trades today.

Majority of PnL came from AERI and CPRX, so definitely a sign that was still overtrading.

AERI: Had a great perception/trade thesis on this, but didn't quite get the execution quite right. Used the $16 level as a guide and ended up with about a $15.90 average premarket full size, before the lower high was established. Basically I just needed to be more patient with scaling in, and I would have got some great, lower risk entries.

Likewise late day, with the SSR on late day I was shorting at market instead of pops, which is another sloppy execution aspect.

CPRX: This was really really frustrating, I was looking to scale in as it went down, and had my limit order in at $2.82 but for whatever reason it wasn't filled. So I kept my cool and then as it started consolidating I entered, was a great tape read because you could see all the shorts trying to crush it... So I waited for a character change and then added aggressively.

ENZN: Was short and noticed it was holding too well, so decided to cut it. Had a serious pop after that, so very happy about cutting it.

MSFT: $47.50 was a decent level on the daily, so shorted into that, tight risk, covered risk, and stopped above.

SHAK: Tried to join the trend late day, but wasn't a high conviction trade, managed to get away with a profit. Need to cut out these sort of marginal trades - no need to force anything.

TRN: The only real loss for the day, and I'm pretty happy with the trade. Was patient to get the best entry, and daily looks like a bounce, along with a 2x ATR move on the open and a curling up action.

Interestingly, the $29.30 was a level on the daily, and so exploiting the level edge there, rather than the curling up action would have resulted in profit (perhaps use curling up action to add).

Friday, 24 April 2015

Trading Review: 04-23-2015

Intraday Trading: -$979. Down day of decent magnitude, but actually pretty happy with the way I traded for the most part. I was very patient for entries and was completely wrong about oil, yet I didn't get carried away and take wider stops etc. Had the complete wrong bias, but each trade went exactly as planned!

The mistake I made today was with ES. Was up very decently and didn't manage any of the position, was going for the "home run" trade - instead of managing correctly. Trading the back account the way I have been hasn't helped my tendency to go for the home run trade.

Swing Trades: -$15.

Back Account: -$15957. Back account has been put more or less back at exactly where it was at the start of the week. This is unacceptable. I figured I would come off the winning streak pretty hard, but hadn't realised I could come off this hard. Will do a blog post over the weekend, on the psychology of how to handle of taking big size trades with high conviction, and how to ensure coming off the run doesn't ruin the net profit.

The general jist is that while I had a good idea today, it didn't do "exactly what I wanted", compared to the trades I took earlier in the week - thus wasn't a high conviction trade. To illustrate the point, I took 4 trades today, all of which were losers (which isn't to say they weren't good trades), prior to today for the trades of the week were roughly a 5/6 winning percentage (again, just because a trade is a winning trade doesn't mean it's a good trade). This illustrates the point about requiring high conviction for the sized up trades.

Overall I'm relatively happy with the way I handled it from a overtrading tilt perspective (which is my usual problem), I wasn't pumping out the trades like a crazy person, the problem was more the way the trades were managed, and the way size was implemented.

First time I have had a streak of "conviction trades", rather than one single one, so some good lessons for the future. No doubt there will be more of these to come because of the shift to get access to more shorts.

Thursday, 23 April 2015

Trading Review: 04-22-2015

No screenshot today, forgot to take one before I went to bed and didn't get up until well after market close.

Intraday Trading (oil only): -$77.Will probably be trading only oil on this account for at least a couple of days. A few reasons for this. The first, issues with PDT. The second, I need to learn to control my risk and be patient, and oil emphasises these qualities immensely. The third, am swapping brokerages so no point in topping up account to withdraw it.

CL: Bearish bias based on daily/hourly. Looking for a bigger picture move to about $54.50-$55. Levels to short into where the $56.66-$56.85 range, and $57.14-$57.40. Got one contract short early in the morning but didn't get a chance to get a second one (missed by one cent, great patience!!!), so was forced to cover at around first target. $56 was a spot to risk 10c on the long, and news came out and met target instantly. Then got met on short offers into the $56.66-$56.85 range and was stopped and opted to retry, and was stopped again. Was starting to get a little frustrated at this point, which paid off, but missed the short into the $57.20 pop (just).

Overall, this is exactly the patience I need to have! So if I can keep it up for a few more days I'll be happy.

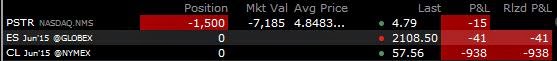

Swing Trades: -$105. PSTR still just chilling out...

Back Account: +$9414. Obviously a crazy day - this is the eptiomy of "conviction trading". Need to continue this, while ensuring that I don't get carried away and take non-conviction trades with the size that I would take a conviction trade with. DO NOT WANT TO GIVE THIS BACK... Don't have any high conviction ideas for tomorrow (except short VLTC which I am unlikely to have shorts for), so avoid trading it aggressively.

LOOK: Shorted premarket and was prepared to short higher, covered in the $1.70s. Good trade. This accounted for about $1000 of the profit.

Comepletely missed the short into the $2.30s which would have been an amazing trade... But not complaining about the day - it's okay to miss trades, if you're trading the ones your trading well.

GBSN: Great setup on the daily, and the news put it into the breakout range. $5 was a key level and then $5.40.

Started in premarket around $4.75. Then got some more on the opening dip around $4.70s.

Added through $5, and then added at $5.50 (which was a bad add). Got final add on the flag consolidation over $5 (basically gap, opening drive, float rotation, and holding above resistance). Sold all 3/4s around $5.74-$6.05 and then was stopped on the remaining 1/4 at $5.29.

I tried a scalp around $5.40s, and while I clearly had the right idea (because it bounced after that) I was stopped on the scalp at $5.29 as well.

Intraday Trading (oil only): -$77.Will probably be trading only oil on this account for at least a couple of days. A few reasons for this. The first, issues with PDT. The second, I need to learn to control my risk and be patient, and oil emphasises these qualities immensely. The third, am swapping brokerages so no point in topping up account to withdraw it.

CL: Bearish bias based on daily/hourly. Looking for a bigger picture move to about $54.50-$55. Levels to short into where the $56.66-$56.85 range, and $57.14-$57.40. Got one contract short early in the morning but didn't get a chance to get a second one (missed by one cent, great patience!!!), so was forced to cover at around first target. $56 was a spot to risk 10c on the long, and news came out and met target instantly. Then got met on short offers into the $56.66-$56.85 range and was stopped and opted to retry, and was stopped again. Was starting to get a little frustrated at this point, which paid off, but missed the short into the $57.20 pop (just).

Overall, this is exactly the patience I need to have! So if I can keep it up for a few more days I'll be happy.

Swing Trades: -$105. PSTR still just chilling out...

Back Account: +$9414. Obviously a crazy day - this is the eptiomy of "conviction trading". Need to continue this, while ensuring that I don't get carried away and take non-conviction trades with the size that I would take a conviction trade with. DO NOT WANT TO GIVE THIS BACK... Don't have any high conviction ideas for tomorrow (except short VLTC which I am unlikely to have shorts for), so avoid trading it aggressively.

LOOK: Shorted premarket and was prepared to short higher, covered in the $1.70s. Good trade. This accounted for about $1000 of the profit.

Comepletely missed the short into the $2.30s which would have been an amazing trade... But not complaining about the day - it's okay to miss trades, if you're trading the ones your trading well.

GBSN: Great setup on the daily, and the news put it into the breakout range. $5 was a key level and then $5.40.

Started in premarket around $4.75. Then got some more on the opening dip around $4.70s.

Added through $5, and then added at $5.50 (which was a bad add). Got final add on the flag consolidation over $5 (basically gap, opening drive, float rotation, and holding above resistance). Sold all 3/4s around $5.74-$6.05 and then was stopped on the remaining 1/4 at $5.29.

I tried a scalp around $5.40s, and while I clearly had the right idea (because it bounced after that) I was stopped on the scalp at $5.29 as well.

Wednesday, 22 April 2015

Trading Review: 04-21-2015

Intraday Trading: -$3024. Was one more oil trade after the screen shot. This is really pissing me off, the back account PnL makes this looks acceptable... But it's not because I did a poor job of controlling my risk. I even manage to catch a decent portion of the oil afternoon fade off, but because traded poorly obviously didn't capitalise.

I still stick by the fact that I have a huge edge in oil, when controlling my risk well (risk kept to 10-20c per trade). Also, as I keep saying, futures will really emphasis when you're trading poorly.

For tonight, I am below the PDT in main account so I won't be trading like normal, but I have a couple of high conviction setups in back account so I will be trading heavily via that. I will also trade oil, which is setting up very nicely for a short, and I will control my risk. This is not a case of trying to make back the money lost, but a case of proving can trade it correctly. I will aggressively look to manage my psychology, perhaps taking a walk after every loss. I will also enter in my stop-loss prior to my entry.

ETSY: Would have made a really nice swing position for a move to the $28-30s, but met my intraday target so took it off.

The fakeout below yesterdays low of $25 was the key to get into the position.

CL: Basically was waiting for price action to tell me what way it was going to go, with a slight fundamental bias towards the short side (for now). Originally in the morning I played the range quite nicely, and then paid the fakeout over $58, which I didn't control my risk very well on - then when I finally stopped out I basically re-entered slightly lower and ripped up some more money. There was never an individual loss greater than (approximately) $700 (which is still too large), which illustrates how I kept re-entering.

Swing Trades: -$26 for the day.

SHAK: Got a downgrade overnight... Ahhh well.

PSTR: Seems to be fading off nicely after yesterday pop. Won't begin to look to cover until the $3.80s.

CRMD: Basically got squeezed and stopped on hold over the $9.50. Would have loved to add there, but with this horrible psych at the moment, as I mentioned yesterday I'm trying to downsize everything.

Back Account: +$8572. Incredible day... I crushed the overnight long on VLTC and sold premarket (before a $4 rally), and absolutely nailed the BIOC short with size.

This $8500 comes approximately from this breakdown:

+$1500 VLTC overnight long.

+$2500 BIOC short.

-$1000 LOOK short. And a slight positive long on the eod.

+$5000 VLTC late day long.

VLTC: Sold this gapper premarket because, although I had noticed the change in character late day - via the mention where-ever it was, it was having no volume premarket (which is usually should if it's going to run like mad). Basically turned into a gap and go, and didn't look back until $14 at 10am, but these things happen and I executed my plan.

The late day long I almost minimised when you consider how I traded it. The setup was the opening drive, which never really pulled back, and a big change of character from the prior few days where it punished those who paid the breakout. I entered 4000 shares around $15.20 which was a chase (but the hold meant extra conviction). I was thinking absolute best case scenario, a measured move from the morning move, and so I didn't actually expect it, and was aiming to hold half until the close.

So I sold half into $16 when it paused, then the 1000 shares at $17.44 (happy with this sale because it made holding the remaining 1000 shares more manageable), and was stopped on remaining 1000 shares below $17 (down $2 or $2000 from peak, which coincided with the measured move)...

Going forward, while it seems like it had a blowoff top, and I would love to CRUSH this short it is important not to be too short biased. It could easily squeeze past $20. The tell will be if it's holding and not going down, slowly grinding up, so for example if it goes red morning (which will load up the shorts), and then manages to grind around and make green midday, a consolidation day (slightly green, near the highs, perhaps slight new high) and then breakout tomorrow would spell another big squeeze. Looking at some of the other major squeezes (LAKE, DGLY), they never had a daily candle with a big wick to the upside like, so I am short biased on pops (at least first the first half of day).

If this does setup for a short (and I have them available, seems unlikely at this stage of the squeeze) I will short serious size, say 4000 shares and then add to position if it moves in my favour - but can't be too impatient waiting for the setup.

BIOC: Shorted size into the $4 pop, covered, and reestablished into vwap. Nailed the morning trade, but missed the reload and late day fade (which was a super nice setup). High conviction short here again tomorrow, pop to $3.40s.

LOOK: Short idea was good, but lacked patience. Was stopped at midday high. Entry was $1.72, when in reality it should have been near the high. Will be a high conviction short tomorrow though - a complete piece of garbage.

Tuesday, 21 April 2015

Trading Review: 04-20-2015

Intraday Trading: -$120. Again felt like a bit of a day risking 4 to make 1. It is for this exact reason that I need to continue on this smaller size goal, and lower the risk profile of the effort made to achieve the goal.

As discussed with Peter, the under-performance from a profit perspective, and risk perspective comes from trying an idea, and then by the time the high conviction setup occurs I have already given away quite a bit of money. I think this comes down to patience and fomo, and a slight lack of methodology. I just can't quite put my finger on what it is I'm lacking in the methodology aspect, to help out with the fomo and patience. I think using starter size will help as well.

SHAK: Joined the breakout. Was impatient about it though, could have easily executed for cheaper. Took half overnight as it's a great bigger picture setup. Weak open r/g setup for tomorrow.

AMPE: Was a classic gap down and look for bounce. Looking back at the trades; this is a prime example of the issue of was having with the fomo and patience. Ensuring using starter size into a wash, and then when it started trending/had higher conviction in bottoming process gets some adds.

HAS: Was really really patience with this so quite happy. Waited for the clear character change on the m5 after the 4ATR move. Narrowly avoided some management. Interestingly, I entered on a pop back to near hod, stop above. Adding at the hod would have yielded a seriously good RR entry and I would have been able to manage.

Swing Trades: -$950. Nasty day on the swings. Was up quite decent on CRMD, and planned to add into pop. Thing is, while I'm not trading well I really need these swings to be in a different account. When you're trying to trade consistently intraday for +$100 and you have swings this size it messes with you. So the question is, what to do now? I could liquidate them and not take on any swing positions until I achieve the consistency I'm desiring, but as I've gone through before, I am better at swing trading... So I still haven't worked this one out!

I think something like GENE, VLTC, DGLY, or LAKE it is silly to stay away from swinging short big size, but something that's not behaving and/or illiquid (like ADXS, CRMD, PSTR)... But seeing as I'm already in the positions better off following the plans (but not adding).

Back Account (realised): -$2616. Was having buying power issues in main account (because I was long something in Australia overnight) and it messed with USD buying power. So had a couple of smaller size trades which were relatively negligible. The big loser was VLTC. This stocks current personality is to fail breakouts and every time it looks weak to hold/wick through. So as it broke out on high volume I was aware of this and waited and waited until it was holding. Then naturally it fell to the trendline and that was the bottom.

Got long some overnight (up about +$600 unrealised).

Sunday, 19 April 2015

Weekly Review: 04-19-2015

Intraday Trading: -$1088. Not much intraday trading this week. Had a few funding issues, waiting for money to clear.

Goal for coming week is to hit the +$100 target each day, and call it a day after that. Create a buffer of profit, before sizing up. If I can do it this week, then I will up to $150 the week after, then $200. While it doesn't quite make sense to set monetary targets, such small targets should be easily achieveable, and after getting some solid consistency for a while I will pull myself out of the psychological pitfall that I'm falling into. The good thing is, that I'm not limited to tiny size on really good setups because I'm not limiting my profit target on swings/back account.

Swing Trades: -$749. It seems like my swing trades have been slowly grinding against me. Recently quite a few of my positions have been options, so I guess that sort of makes sense! Really need to get to my bread and butter of getting swing shorts on hyped up stocks, hence why I took the PSTR short with reasonable size.

Recently I have been following the hyped up stocks, but then beginning to ignore them when they lose favour, which is when shorts become easily available, and the high probability trades begin.

From this perspective, something like VLTC should be a really nice swing short soon. While CRMD and ADXS I should be looking to short pops from here on out. Remember that with VLTC just leave orders in, and they will be filled when shorts become available.

Back Account: -$1743. Was only one trade that ended up setting up in the back account this week (ADXS) and one spontaneous bad trade (WUBA). For all of the week I didn't have access to the shorts that I usually do with this account which was frustrating because there were some really nice setups that I probably would have crushed. And then some ones which I may have had trouble with (VLTC).

Goal for coming week is to hit the +$100 target each day, and call it a day after that. Create a buffer of profit, before sizing up. If I can do it this week, then I will up to $150 the week after, then $200. While it doesn't quite make sense to set monetary targets, such small targets should be easily achieveable, and after getting some solid consistency for a while I will pull myself out of the psychological pitfall that I'm falling into. The good thing is, that I'm not limited to tiny size on really good setups because I'm not limiting my profit target on swings/back account.

Swing Trades: -$749. It seems like my swing trades have been slowly grinding against me. Recently quite a few of my positions have been options, so I guess that sort of makes sense! Really need to get to my bread and butter of getting swing shorts on hyped up stocks, hence why I took the PSTR short with reasonable size.

Recently I have been following the hyped up stocks, but then beginning to ignore them when they lose favour, which is when shorts become easily available, and the high probability trades begin.

From this perspective, something like VLTC should be a really nice swing short soon. While CRMD and ADXS I should be looking to short pops from here on out. Remember that with VLTC just leave orders in, and they will be filled when shorts become available.

Back Account: -$1743. Was only one trade that ended up setting up in the back account this week (ADXS) and one spontaneous bad trade (WUBA). For all of the week I didn't have access to the shorts that I usually do with this account which was frustrating because there were some really nice setups that I probably would have crushed. And then some ones which I may have had trouble with (VLTC).

Trading Review: 04-17-2015

Intraday Trading: +$107. Well I achieved my $100 goal, but overall it really felt like a "risk 4 to make 1 day". Which is annoying... But realistically it's a sign that I should continue to try and achieve the smaller goal consistently before expanding.

After the WUBA loss on back account right on the open I brought the frustration to my main account on WUBA and also traded it badly (with smaller size) there.

SHAK: Made the same mistake I made the previous day. Scaling in too earlier, and as a result it didn't make sense from a RR standpoint to sell into $61. Need to be sure to pick my spots better and scale in at a tighter range. Would have been a really solid trade if I had picked my spot better.

Sold when I met $100 target for the day which was roughly midday when it started grinding down. Again, it flushed through the $60 level (this time a little less) so looks to be setting up nicely for a squeeze.

WUBA: Was extremely volatile with a big spread on that huge opening move. Flipped to long as it was holding but was a chase and wicked out. Stayed away as much as I could after that, but got a nice short off as it was over/under vwap around 11am. Covered far too quickly around $68, but then waited patiently, wanted the opening print ($63) but there was some clear bottoming action so I tried the long there. Rebounded a lot more than expected! But I sold quickly as it was just a scalp against the downtrend.

ROSG: Pretty happy with the trade despite the loss. Was gearing up, after holding the gap all morning. One thing I would change about the trade is getting long closer to the gearing line, maybe half where I did, and half on better dip. One thing that I did a great job of was stopping out after bias was negated - despite not hitting my stoploss.

Swing Trades: +$188 (this screenshot isn't updated for the close).

Back Account: -$1743. Had the first slipup with this account. Basically I had a three high conviction trade all setup to trade heavily (and all worked funnily enough), so I was prepared to trade either one of these 3 if they setup as planned. So one of them (CHOP) ran out of shorts moments before the time came to short it. The second one I couldn't access on the charts for some stupid reason (NVIVD), and ADXS eventually set up later in the day.

So I was prepared for trading on the back account, and then WUBA popped up with a massive move, and for some reason I just shorted it aggressively. There was a moment when it was at roughly breakeven and I "sort of" knew I had made a mistake jumping in and shorting it. I need to get better at doing what I should do (aka in this case acknowledging mistake and cutting out once mistake identified).

WUBA: As aforementioned was a horrible trade... No more need to be said on that I think.

ADXS: $20 was a key level that I wanted to short around, so I waited for confirmed failure at $20 and shorted around $19.50-$19.60 heavily. It came off about $1 but I never covered anything. Ended up covering eod for about +10c. Was a great patient entry, but just horrible trade management.

Thursday, 16 April 2015

Trading Review: 04-16-2015

Intraday Trading: -$1195. Really really frustrating day overall. Was up quite big on SHAK at one point, but gave it back, and was up quite big on oil but also gave it back. Giving back the oil was slightly out of my control but SHAK definitely wasn't.

Controlled myself pretty well given the frustrating day though. Was down reasonable on ADXS early on in the day and fought back with good, solid, disciplined trading.

I think there's a good lesson in SHAK: Basically what happened (from a position management point of view) was that I slightly oversized myself and so while it hadn't reached target I was up quite decently (unintentionally). For the future I need to bear in mind that this is a sign that I'm oversized and take some off immediately.

In a little bit of a rut with my intraday trading, so am going to pull sizes right back and aim to string together five +$100 days in a row. I feel like the rut might be about to start affecting my trading and so it's the appropriate time to pullback. I still have back account for any higher conviction setups that I want to take with size. Because of the way minds work, I shouldn't be psychologically affected when trading the back account.

Having issues with charts and platform for some reason, and have somewhere to be soon so won't go through each individual setup... Just sum up the notable trades.

ADRO: Hot ipo on second day. Was setting up for a long or short right around vwap. Volume had died off (indicative of disappearing hype), then it popped over vwap and didn't hold, was smacked right back down. This turns it into a short bias, but I stayed long and wide stop from chase. Stop was $1 lower on around 250 shares, but it completely dropped out so I encountered really really nasty slippage which caused it to be about a $700 loss instead of the $250-$350 at stop (which is already unacceptable). It then dropped another approximately $3-$4 and I tried fading the late day movement and was stopped which bought it to $1094.

CL: Was up about $700 on 1 contract and was offering out at planned target but it missed by 2c!! And was stopped around breakeven.

SHAK: Have already alluded to, but there was one other thing with it, which was that it was setting up a pattern of lower highs, so I should have eased off aggression on long.

Swing Trades: -$164.

PSTR: Took on a new swing trade today. Pretty decent size. Wanted to short it on the open from an intraday perspective and get quite big but not enough liquidity. Hourly setup is nice. It's a bit of a chase, but I remember from last time that it never had a bounce to get short aggressively, so have to chase a little bit.

Need to be a little weary if oil keeps spiking, people may go to low float oil stocks.

Saturday, 11 April 2015

Weekly Review: 03-12-2015

Intraday Trading: -$1434.

Overall really disappointing week again. Especially after the lapse on the first day of the month, and then the effort to learn from it. Really don't want to fall in a cycle of making this lapse of discipline a habit. I know what I have to do, and I know what I need to do at the time that I have these psychological lapses but for whatever reason choose not to do it.

- I feel like the daily goal of $600 works quite well, so will keep that on for now.

- I need to have a 20 minute refresher nap halfway through the day.

- Goal for this week is to do "what I should do" when I realise that it's what I should do. I know the rules etc I need to obey, now I just need to obey them.

Swing Trading: -$315. Nothing much going on here to speak of. Hopefully get some good trades soon.

Back Account: +$7390. Obviously massive week, arising mainly from PSTR. Thus far just need to keep it up and make sure I'm not trading in back account for the sake of it... Only keep the highest conviction trades to back account. PSTR prime example because I was shorting day 1 but I waited until the perfect time to short (aka was extremely patience).

As a general note: I haven't traded fx for a while, so will put in some work on my fx methodology in the next day or so to ensure that I'm not missing any opportunities there.

Overall really disappointing week again. Especially after the lapse on the first day of the month, and then the effort to learn from it. Really don't want to fall in a cycle of making this lapse of discipline a habit. I know what I have to do, and I know what I need to do at the time that I have these psychological lapses but for whatever reason choose not to do it.

- I feel like the daily goal of $600 works quite well, so will keep that on for now.

- I need to have a 20 minute refresher nap halfway through the day.

- Goal for this week is to do "what I should do" when I realise that it's what I should do. I know the rules etc I need to obey, now I just need to obey them.

Swing Trading: -$315. Nothing much going on here to speak of. Hopefully get some good trades soon.

Back Account: +$7390. Obviously massive week, arising mainly from PSTR. Thus far just need to keep it up and make sure I'm not trading in back account for the sake of it... Only keep the highest conviction trades to back account. PSTR prime example because I was shorting day 1 but I waited until the perfect time to short (aka was extremely patience).

As a general note: I haven't traded fx for a while, so will put in some work on my fx methodology in the next day or so to ensure that I'm not missing any opportunities there.

Trading Review: 04-10-2015

Intraday Trading: -$1929. Really really disappointing day. Started off fine, and then I feel like I wasted all my psychological energy trading the massive size in back account. All it would have taken was a simple walk and/or to refresh and calm the mind... Broke max loss for the day, and broke the rules surrounding maximum losing amount of $300. Pretty pathetic really.

Also was plenty of opportunity on stocks, but got stuck on oil. Unlike other big losses of this size recently, this one was a result of overtrading, rather than stoploss issues.

One positive: I nearly got rewarded for sticking with the bad trading, got back to breakeven, and slightly positive when I was down around $1500, but then gave it all back and then some. Reality is this is good, don't want to reinforce bad habits.

Negatives:

(1) Exceeded the $300 rules.

(2) Exceeded the $1000 max loss intraday.

(3) Increased size (marginally) after losses.

(4) Recognised what was going on, but carried on anyway (hope and lack of discipline).

(5) Overtraded like crazy. There were actually some good trades available on oil, but missed them completely/didn't capitalised.

CL: Too many trades to even draw the arrows on effectively. There were two trades I was interested in coming into the day. Short into the Asian session high, which would have execution of around $50.80-$51. And short into $52. Instead was just all over the place, buying and selling, irresponsibly managing, and (as a general jist) fighting the trend.

Interestingly, I always had stops in place, but they were always a little wide, the result of chasing (emotionally).

JRJC: Tried for the weak open r/g type play, didn't work and good trade/stop.

HZNP: Basic scalp shorting the gap up and covering into support. No need to fight the trend on this beast, so only short scalp.

Swing Trades: -$79.

AXN: Still just chilling around. Sentiment on twitter etc still extremely positive after that false break throughout the week. I view that as a good thing, but the way it is holding is annoying. I think if it hasn't broken lower within a week I will have to use a time stop on it.

LL: Again, I feel like I structured this wrong. At some point the time stop will go off and it will be annoying to liquidate two positions instead of 1, and therefore cross spread more times than neccesary. That being said, it's consolidating and holding. so the possibility for a squeeze is slowly getting higher and higher.

Back Account: +$3989.

PSTR: I don't remember the specific sizes I had at each point, but I was holding 6000 shares short for a decent period of time. I had tried to long this on a weak open r/g type move but missed fills by a couple of cents. Good example of scaling versus all entries at a specific price.

$6.60 represented resistance from a prior float rotation, and an approximate measured move, plus around the max move it has made on big moving days. So I offered decent size into $6.60 and ended up with an average of $6.50. Managed quickly to lock in, and offered back.

Could have rinsed and repeated to cover a bit more risk, but my charts were screwed up so I thought it was below vwap when it wasn't.

Gave a little trouble with a $6.50 stuff, but from there it was game over.

Ended up with a $6.35 average for 6000 shares and covered 1/3 $6.10 (seconds before the crack), and the rest around $5.70. I covered entire position instead of holding 1/3 until the end of the day (like the plan was) but oil messed up my trading and decided to cover it all and take the rest of day off. Did a 2000 share short around $5.90 when it tested vwap but covered quickly for a scalp. Again, didn't want to be involved because of oil.

Basically how the play should have gone was once the $6.00 line in the sand/vwap was toast and it got the low volume kiss of death I should have been shorting against $6.00 heavily aiming to hold until end of day...

In summary, nailed the first portion of the trade (could have done with a little better management), and didn't quite get the second part right, but overall really really solid trading with massive size.

Updated intraday graph. Obviously really disappointing trend. More on that in weekly review coming.

Subscribe to:

Comments (Atom)