Monday, 27 April 2015

Trading Review: 04-24-2015

Intraday Trading: -$45. Just an oil trade that had the PnL reset for some reason - was stopped at approximately breakeven on it.

Swing Trades: +$75.

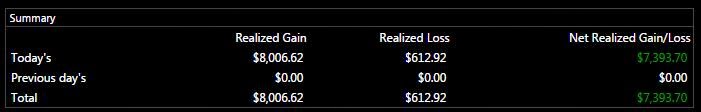

Back Account: +$7393. Continued today with the theme of high conviction trades in back account. Had a great deal of thinking about how to take the high conviction trades, and had a friend sitting with me to help ensure that I was only taking the really high conviction trades. The lessons learned from this week of trading in the back account are really really helpful and will aim to continue it this week.

There was plenty of solid trades today, but for the future will only be looking to take 1-2 trades today.

Majority of PnL came from AERI and CPRX, so definitely a sign that was still overtrading.

AERI: Had a great perception/trade thesis on this, but didn't quite get the execution quite right. Used the $16 level as a guide and ended up with about a $15.90 average premarket full size, before the lower high was established. Basically I just needed to be more patient with scaling in, and I would have got some great, lower risk entries.

Likewise late day, with the SSR on late day I was shorting at market instead of pops, which is another sloppy execution aspect.

CPRX: This was really really frustrating, I was looking to scale in as it went down, and had my limit order in at $2.82 but for whatever reason it wasn't filled. So I kept my cool and then as it started consolidating I entered, was a great tape read because you could see all the shorts trying to crush it... So I waited for a character change and then added aggressively.

ENZN: Was short and noticed it was holding too well, so decided to cut it. Had a serious pop after that, so very happy about cutting it.

MSFT: $47.50 was a decent level on the daily, so shorted into that, tight risk, covered risk, and stopped above.

SHAK: Tried to join the trend late day, but wasn't a high conviction trade, managed to get away with a profit. Need to cut out these sort of marginal trades - no need to force anything.

TRN: The only real loss for the day, and I'm pretty happy with the trade. Was patient to get the best entry, and daily looks like a bounce, along with a 2x ATR move on the open and a curling up action.

Interestingly, the $29.30 was a level on the daily, and so exploiting the level edge there, rather than the curling up action would have resulted in profit (perhaps use curling up action to add).

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment