Thursday, 26 February 2015

Trading Review: 02-26-2015

Intraday Trading: -$955 for the day. Overall horrible day. Traded first half of the day perfectly and was up a little over $1000 at one point (around 11:30am), despite only 2 of my ideas really working (EYES and CLDX). In the lunch-afternoon period my "confidence" in my underlying ideas which hadn't worked increased and I basically ended up compounding losses before eventually tilting for the last hour an a half or so.

The tilt wasn't anywhere near as bad as it could have been given how many of my ideas weren't working (more on idea generation process for each stock in individual descriptions).

Reflecting on individual goals:

(1) Controlling risk: Obviously risk wasn't very well controlled. However a couple of things stand out. The first is letting individual stock losses exceed the $300 limit I set. This was really a case of getting frustrated when my idea wasn't working, so trying it again. Poor trading. Secondly I didn't really use starter positions to my advantage, again this became worse as the day went on, I used starter positions perfectly on CLDX for example. Thirdly, it is absolutely ridiculous to go from +1000 to -1000, this is poor control of risk and too larger drawdown to experience when I am trying to improve my consistency.

(2) Focus on getting correct patient entries: I managed to do this perfectly on the open. On the open until about midday ish I was up enormously on CLDX and it was the only trade idea that had worked (along with small EYES). Despite this, I was near neutral on the other stocks I had traded at that point because I focused on getting the perfect entries. Later in the day, I lost this and had wider stop-losses. Again, when you go through individual trades it appears that they would have worked quite well with better entries, despite the "idea" not working.

(3) Overtrading: I actually managed to keep this relatively under control. Usually this is the area I lapse in when I go on tilt, however in this case my poor trading/tilt was more related to being patient for entries and controlling risk (size of negative on each stock, and letting drawdown be too large). Obviously I traded quite a few tickers today, but each of them was a reasonable idea I think.

(4) Scanning for ideas: Was plenty of stocks to trade today, and I did do some scanning, but didn't find too much extra. However, just as food for thought. This is a good idea when I take a decent hit on a stock to get me away from that stock and a fresh train of thought.

Overall, I am very happy with the way I traded in the morning, it was obviously a hard day with literally nothing working out fully. However, the afternoon was just atrocious and not acceptable. I think when I feel myself get frustrated like that I need to step away from the computer, log off the platform (so I can't see it), and just chill out for a bit. Perhaps play 15-20 minutes of micro stakes poker to get in the grinding meditative zone.

One thing I am contemplating, just as a temporary thing (this would be foolish longer term for limiting growth reasons), is to log off and stop trading when I reach +$1000. The reason being, that the simple act of doing this for the next week-month will hone in the focus on consistency. While it is true that if I had traded my ideas perfectly I would have ended the day >+$1000, the reality is that I'm not concerned about that if I am getting cocky/reckless when I'm up +$1000 on the day and using more size than I should be.

EYES: I had shorts to borrow in main account on the open, so I put up some offers into levels and got taken for 100 shares, then the borrows disappeared. At $12.89 I got short 400 shares in my back account for a swing trade down to mid 11s ish. I was going to close this 100 shares midday when it was holding, but decided to swing the 100 shares as well to ensure I didn't lose sight of the back account swing and what EYES price action was doing. Lucky I did keep the short!

NSM: Tried to get in on one of the 1c consolidations short and was wicked out. Re-entered, and covered risk, but never got what I was going for. Reasonably happy with trade, although a tad large for just a standard grinder trade.Interesting trading stock.

MBLY: Got long against the low at some point early in the day and was stopped out. Should have kept an eye on it, that midday move was quite big. Good RR trade, idea probably not the greatest in hindsight, given daily downtrend, holding below vwap etc.

LL: This and CRM were the stocks that really screwed me because I kept trying the same idea over and over again, when in reality I shouldn't have been so biased towards my idea. As mentioned earlier, focusing on entries would have same me some decent money, and probably allowed me to objectively view the price action rather than being biased.

From the mid morning action you can see that $50 was a good level to watch, and could be treated as an inflection, particularly because it coincided with vwap. So 11am when it reclaimed that you notice the change in character and look for long entries... But it's just moved $1.30ish in less than half an hour, so no point entering anywhere near there. Instead let it consolidate and tell you where the next entry is (patience!). The following washout to low $49s (which stopped me out of my small chase) was a sign of weakness, but also a good spot to load up if you were quick enough and biased enough for your view. Again the reclaim of vwap/$50 put bullish scenario back on point. But then it over/under vwap/$50, and then failed at the e/g test with a slightly lower high, this was the sign to quit the bullish bias (flexibility in bias), and realistically get short, either against $50 once it held below, or against $50.50 if you got a good enough entry. Remember that at about 1pm it had reversed off the lows, but had tried to get green and hold vwap for 2-3 hours and just couldn't convincingly.

Then late day I had my most tilted trade. Pissed off that there was a possibility my idea was going to work because it wasn't going to be on 60 minutes I chased it with 800 shares (huge position) and took about a $400 loss on that trade. Poor trading.

INOV: Tried to join the trend, but it couldn't hold green, so I cut it. Another example of an idea today that was fine but just didn't work.

FSLR: Tried a few low risk type trade, the first against the hod and previous days hod (purely a scalp, risk 10c for 30 type of thing) and then long into the midday support and g/r area. Both didn't work, which is frustrating, but that's just the way it is. Should probably have anticipated it to wash through vwap on that second one I guess, was just one wee downmove too early.

CYTX: This was freaking pathetic, this was a pure tilt trade and was too much size (2000 shares). I chased the new high of day, which was of course stuffed. Funny thing is I never liked it long compared to others like BIOC because of the enormous float, but as a tilted idiot I loved chasing the fakeout... Deserved the fate I got.

CYCC: I managed to play this one how I should have played CYTX, but it didn't work... Picked up some on dips but just didn't catch a late day bid so that's okay.

CYBR: Tried to join the trend late day, was wicked out by a nasty spike with spread so got back in (patiently!) but it just didn't work.

CRM: The other cock of the day... Gapped up on earnings, trending nicely in ah and pm... Was looking buy dips on open accordingly, and actually traded it quite well, although I missed some opportunities to lighten up, but did a great job of staying breakeven, and decently profitable at some points (where I didn't take enough off). Buys dips was working well, but then as it started to hold I began to average up looking for trend continuation (which is fine, it's a viable trade), but I need to look after my average a bit better. With appropriate trading I could have easily been (slightly) positive on this stock, despite having the wrong direction. I tried to buy into $69 around 2pm but just missed entry.

I drew some lines so you can sorta see what I was looking for, but yeah just didn't work (the downtrend one comes from premarket and was really consistent until broken).

CLRX: This was purely an impulsive trade. Was looking for an abcd, was too far off the secondary support level, once below vwap it was toast.

CLDX: Stock of the day. Traded small on open into the secondary price of $24. Premarket I think the secondary support price isn't as strong so you want to buy a wash below. Literally couldn't have traded this any better. Got size in the right places, covered risk quickly etc. Was probably a little top heavy at some points (i.e. hadn't taken enough off because I got such large (responsible) size near the bottom, but good stuff. This is a stock that I would have gotten into trouble with if I hadn't looked after my average because of the rinse and repeat back to $24 trade. Think I managed to rinse and repeat about 8 times!!! Purely for interest I counted how many shares I turned over on this stock, traded 13,400 shares!! Crazy stuff. Again, it was very responsible stuff as well. Risk >$0.10 for >$0.2, rinse and repeat. have included a zoomed in chart of the action around open where you can see my executions (red is sales, blue is buys).

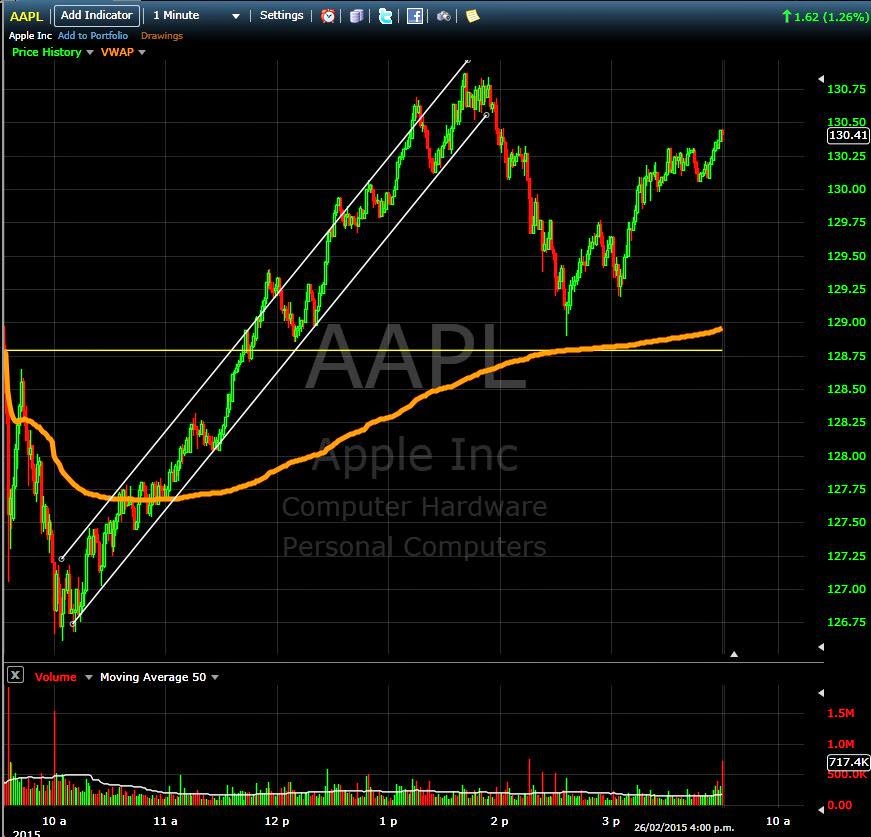

AAPL: Played the AAPL moves with the options, rather than the the underlying. Basically tried to fade the move from red to green for a scalp (which obviously didn't work), and probably wasn't a good idea given the rumours/news whatever it was with TSLA. Later I nailed the fade, and you can see the RR was worth it (I didn't even hold it the correct amount of time!). Tried to reload long around r/g but missed executions on calls.

EDIT: Looking back, there were a couple of improvements which would have limited losses (ignoring the tilt). The main one being that starting in positions lighter, would have enabled scaling at better prices etc, thus helped a lot with those stocks that I didn't have the right bigger picture idea on.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment